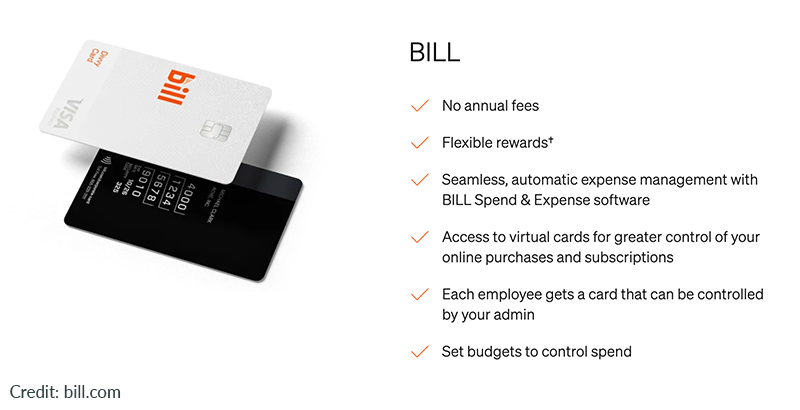

BILL (previously Divvy) is a relative newcomer to the corporate credit card market, but they’re making a big impact. Their corporate card offering has several features that set it apart from the competition and make it appealing to new startups.

We’ll take a comprehensive look at the BILL Divvy Corporate Card and compare it to other leading players in this space. We will cover everything from pricing and features to reviews and eligibility.

Get Started With BILL Divvy Today

Streamline your corporate spending with intelligent cards that automate expense management and put you in control.

Get StartedWhat Is the BILL Divvy Corporate Card?

Used by major companies like Noom and Qualtrics, the BILL Divvy Card provides businesses with access to credit lines of between $1,000 and $5 million. The company offers flexible underwriting to meet the needs of diverse businesses as well as quick virtual cards with spend control features for team spending.

Additionally, BILL Divvy cardholders receive access to the powerful spend and expense management features to automate expense management and control their business budgeting with ease.

BILL Divvy At a Glance

| Annual Fee | None |

| Regular APR | None |

| Best For | Businesses looking to issue corporate cards to employees and gain access to robust cash-back rewards |

BILL Eligibility Requirements

There aren’t many requirements to be considered for the BILL Divvy Corporate Card. It’s one of the better options for those who don’t already have business credit but are looking to build a history. It requires a security deposit that ends up being the amount of credit you have available. As you pay your credit on time, you can eventually transition into a regular credit account.

Below are the eligibility requirements for signing up for a BILL credit account:

- Must have a US bank account

- Must have a US EIN

- One person in the business must be a US citizen or resident and own 25% or more of the business.

BILL does prefer small to medium-sized businesses, so the card may not be ideal for corporations or large businesses. However, any type of business structure can apply to BILL, whether it be a sole proprietorship, an LLC, or a partnership.

Pros & Cons of BILL Divvy Corporate Card

Pros

- Rewards offered based on payoff frequency

- Excellent budget management features

- No hidden or annual fees

Cons

- Lack of integration options

- Lack of customization for alert systems

Apply for the BILL Divvy Corporate Card

Transform how your business handles expenses with automated expense management, custom spending limits, and cash back rewards — all with no personal credit check required.

Get StartedBILL Divvy Corporate Card Fees & Features

BILL Divvy Corporate Card is a good card for beginning entrepreneurs building business credit because it has very low fees with good rewards. Below is a list of all the features and fees you can expect when using the card.

Rewards and Benefits

- Automatic expense reporting

- Budget customization allows you to set spending and budget limits for each project, event, or any other category of your choosing

- Choosing a higher frequency when paying your account balance leads to more reward points for purchases of specific items

Interest Rates

- 0% APR on purchases for the first 12 months

Fees

- No annual fee

- Late fees: 2.99% or $38

- Foreign transaction fees: 0.2%–0.9%

BILL rewards customers who pay off their bills more frequently. Those who set up consistent automatic payments will receive higher reward points for purchases on eligible categories.

Although there are no interest rates for BILL for the first 12 months, you’ll need to talk with a customer support agent to determine what normal rates apply. Unfortunately, BILL leaves out any information regarding interest rates from their website.

How Does BILL Divvy Compare?

BILL Divvy stands out in the corporate card market for its strong expense management features and built-in budgeting tools, although it faces stiff competition from newer fintech players that offer innovative solutions. Mercury, Brex, and Rho are a few of BILL’s top competitors, and here’s how their corporate credit offerings compare to the BILL Divvy card.

Mercury IO vs. BILL Divvy

The Mercury IO credit card is the Mastercard offered by Mercury, a startup-focused banking solution. Both the Mercury IO and BILL Divvy cards include instant virtual cards for team members, spend management tools, and unlimited 1.5% cash back on purchases. Additionally, neither business credit card requires an annual or monthly fee to maintain. Mercury’s strength lies in its high credit limits, built for startups, as well as the access customers have to the platform’s startup-focused features like checking and savings accounts, Mercury Treasury, SAFEs, and more.

Brex Corporate Card vs. BILL Divvy

Brex and BILL Divvy target slightly different segments of the market. Brex’ offers its banking and credit services exclusively to venture-backed startups and tech companies, providing higher credit limits based on cash balances and venture funding rather than credit history. While both provide expense management tools, Brex typically offers more generous rewards on categories like software and ridesharing services. BILL Divvy, meanwhile, appeals to a broader range of businesses with its more traditional underwriting approach and emphasis on budgeting controls and workflow automation.

Rho vs. BILL Divvy

Rho and BILL Divvy share similar core features in terms of expense management and corporate cards, but Rho differentiates itself by offering integrated treasury management and accounts payable (AP) automation services. While BILL Divvy excels at departmental budgeting and spend controls, Rho provides a more comprehensive banking solution with features like international payments and working capital optimization. However, Rho’s corporate credit card requires a higher minimum balance at $50,000 and offers lower cash-back percentages than BILL Divvy.

Below is a table comparing the key features of BILL Divvy, Mercury, Brex, and Rho corporate credit cards.

Features Comparison

| Card | Annual Fee | Regular APR | Rewards | Minimum Balance |

| BILL | $0 | None | 1.5% cash back | $20,000 |

| Mercury IO | $0 | None | 1.5% cash back | $25,000 |

| Brex Card | $0 | None | 1%-7% cash back | $50,000 |

| Rho Card | $0 | None | 1.25% cash back | $50,000 |

Is the BILL Divvy Corporate Card Right for Your Startup?

The BILL Divvy corporate credit card includes a comprehensive set of features and capabilities for distributed teams. But, is it the right fit for your startup’s credit needs?

It’s particularly well-suited for:

- Companies seeking a credit card with built-in spend management and no personal credit score requirements

- Businesses that want to issue multiple employee credit cards with customizable spending limits

- Organizations looking to earn cash-back rewards while automating expense reports

However, it may not be the best fit if:

- You need a charge card with higher spending limits based on venture funding or cash balances

- Your business requires specialized, industry-specific credit card rewards programs

The bottom line? The BILL Divvy corporate credit card combines flexible credit limits, automated expense management, and meaningful cash-back rewards into one solution that eliminates the hassle of expense reports. Its ability to set real-time budgets and spending controls directly on the card makes it a standout choice for businesses looking to streamline their corporate card program.

Power Up Your Corporate Cards

Take control of company spending and say goodbye to expense reports with BILL Divvy’s smart corporate credit card solution.

Get StartedFrequently Asked Questions

How does a BILL Divvy Corporate Card work?

The BILL Divvy Corporate Card is free to use and has no annual fees. They make their money by charging the merchants who make purchases with a small fee for each transaction. Businesses can earn reward points based on how frequently they pay their bill off.

How long does BILL credit take to approve?

You will know if you get approved for the BILL Divvy Corporate Card right after applying through the company’s website. Once you’ve filled out the application, BILL will complete a quick credit check of your history and determine if you are eligible. Then, you’ll receive information from BILL on whether or not you were approved minutes after applying.

Is BILL Divvy Corporate Card a credit card or charge card?

BILL Divvy Corporate Card is a charge card that does not allow you to carry a balance for purchases made. Instead, the total owed is due each month on a given date. You have several repayment options, but the most frequent options will receive higher reward points for specific purchases.